What Exactly Is Automated Trading In Cryptocurrency? What Strategies And Tactics Can One Employ To Accomplish It? Automated crypto trades refer to the use of algorithms or computers to make trades in the market for cryptocurrency. These programs are designed to adhere to specific rules of trading in order to maximize profits while minimising losses.

You have many options for automated trading software. It's crucial to select a reliable one that has a proven history and is compatible with your trading needs.

Before you start automated trading, it's important to create a strategy for trading. This includes identifying the conditions in which you'd like to trade, making a decision on the entry and exit points, and creating stops loss orders.

Be sure to implement a risk-management system Any automated trading system that has been successful should incorporate a risk reduction system. This will reduce the chance of losing money. This could include setting the stop-loss limit and restricting the amount of money that can be traded simultaneously.

Test your strategy prior to starting trading. This will allow you to identify areas of weakness and make the needed adjustments.

Automated trading systems need to be monitored: Although automated trading may reduce time, it's vital to watch the system to ensure it's functioning correctly.

Be aware of market trends. If you want to succeed in the automated trading of cryptocurrency, it's essential that your strategy is constantly up-to-date.

Diversified portfolios are an excellent idea. The market for cryptocurrency is a volatile market. To spread out the risk and maximize potential gains It is advantageous to keep a mix of currencies and investments within your portfolio.

Automated cryptocurrency trading is a complicated process that requires solid software, a well-defined trading strategy and effective risk management. Take a look at the most popular

crypto trading backtesting examples for site examples including free trading chat rooms, liyeplimal crypto currency, crypto trading tips reddit, stock market forums usa, auto trading strategies, crypto futures trading us, automated trading apps, best coin trading platform, cryptocurrency trading simulator, swing trader community, and more.

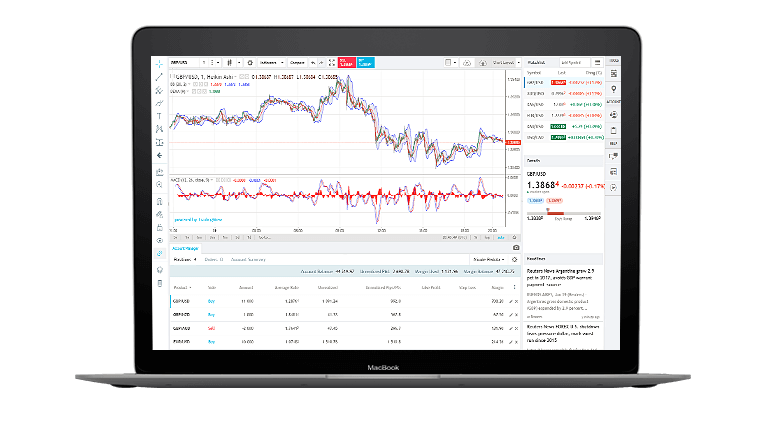

What Forex Backtesting Program Do You Use And How Can You Optimally Use It?

What Forex Backtesting Program Do You Use And How Can You Optimally Use It? There are a variety of options available for forex backtesting software. Each has its own unique features. The most well-known options are MetaTrader 4 and 5. MetaTrader is a popular forex trading platform with a built-in strategy tester for backtesting trading strategies. It lets traders test strategies using historical data, optimize settings, and evaluate the results.

TradingView: It is an online charting and analytics platform that also includes an option for backtesting. It allows traders the ability to create and test strategies using their Pine Script programming languages.

Forex Tester Forex Tester is a standalone software is specifically made to test trading strategies. It comes with a range of analysis and testing tools. You can also simulate different market conditions to test multiple strategies simultaneously.

QuantConnect: A cloud-based platform which lets traders to back-test forex strategies as well as other trading strategies with several programming languages like C#, Python and F#.

Here are some tips to make sure you get the most benefit from your backtesting forex program:

Determine your strategy for trading. Before you start backtesting, you need to define the rules and criteria you will use to trade into and out. This might include technical indicators, chart patterns or other criteria.

Now you can set up the backtest using the software you prefer. This typically involves choosing the currency pair that will be traded, the timeframe to be tested, and other parameters.

The backtest can be run: After you've set up the backtest, you can begin the test and check how it would have performed in the prior. Backtesting software generates reports with the results of every trade.

Review the results: You are able to analyze the results following the backtest to see the effectiveness of your strategy. If you want to improve the effectiveness of your strategy, you might consider changing it according to the results of the backtest.

Forward-test the strategy. After you have made any adjustments, test it on an account that is demo. Or with some actual money. This will let you test how the strategy performs under real-time trading conditions.

With the help of a forex backtesting program, you can learn valuable information about how your strategy might have performed in the past, and then use the information to improve your trading strategy going forward. Take a look at the top

automated forex trading for site examples including robotic stock trading software, pro real time automated trading, interactive brokers crypto, cryptocurrency buy and sell app, best mobile crypto exchange, etrade options forum, crypto trading no fees, thinkscript automated trading, coindcxpro, renko automated trading ea, and more.

What Does An Automated Trading Robot Appear Like?

What Does An Automated Trading Robot Appear Like? An automated trade bot is an electronic program for computers that performs trades for traders. These bots analyze the market's data such as price charts or technical indicators and make trades based on the strategies and rules established by the trader. C++, Java, Python, and Java are all popular programming languages. The preference of the user will determine the program or platform that is employed and its compatibility to the platform for trading.

These platforms and software may be used to develop automated trading bots:

MetaTrader The MetaTrader platform allows traders to design and run automated trading robots using MQL programming language.

TradingView: This platform provides traders the ability to create and analyze trading strategies with their Pine Script programming language.

Cryptohopper: This platform was designed specifically to automate cryptocurrency trading. Users can create bots with the form of a visual editor, and backtest strategies with historical data.

Zenbot is an open source cryptocurrency trading bot. It can be customized for use on Windows, macOS, Linux and many other platforms.

Python-based libraries: There exist several Python-based library applications, like PyAlgoTrade and Backtrader which allow traders to create and automate trading robots with the Python programming language.

In the end, the particular software and platform that is used will be based on the needs and knowledge of the trader, and also the compatibility of the trading platform and exchange being used. See the top rated

the full details for more advice including fx crypto, tradingview automated trading forex, binance us futures, interactive brokers crypto, lowest fees for crypto trading, understanding cryptocurrency trading, intraday trading cryptocurrency, digital currency trading, zulutrade forum, live traders review reddit, and more.

How To Analyze Backtesting Results To Determine Whether A Trading Strategy Is Profitable Or Risky?

How To Analyze Backtesting Results To Determine Whether A Trading Strategy Is Profitable Or Risky? Analyzing backtesting results is an important process to determine whether an investment strategy is both risky and profitable. To analyse backtesting results, you follow these steps in calculating performance indicators. This is the initial stage in analyzing results from backtesting. It is the process of the calculation of performance metrics like the total return, the average return, and the maximum drawdown. These metrics help determine the profitability and risk associated with trading strategies.

Comparing to benchmarks. A comparison between the benchmarks and performance indicators (e.g. the S&P 500) can be useful as a reference point for how the strategy has performed in comparison to the other markets.

Assess the risk management techniques: Look at the risk management methods in your trading strategy. Examples include stop loss orders and position sizing. To determine the effectiveness of these tools in reducing the risk,

Trends: Examine the performance over time to identify patterns or trends in profitability , and/or risk. This will allow you to identify areas that may require adjustment.

Analyze market conditions: Determine how the strategy performed in different market conditions during the backtesting time.

Backtesting with different parameters: Test the strategy with different parameters, such as risk management strategies or rules for exit and entry to determine how it performs in various situations.

Modify the strategy as needed: Based on the results of the backtesting analysis, modify the strategy as needed to improve its performance and lower risk.

To analyze the results of backtesting, it is necessary to conduct an in-depth analysis of performance metrics , strategies for managing risk markets, as well as other factors that can impact the risk and profitability. Backtesting results can be a fantastic way for traders to identify areas to improve and adjust their strategy to suit. Read the top

automated cryptocurrency trading hints for site info including option trading chat rooms, robinhood crypto trading fees, automated futures trading systems, pbx trading reddit, forex crypto trading, cfd auto trading, nse robot trading, top ten crypto exchanges, free day trade chat rooms, auto money trader, and more.

How Do You Make The Most Effective Anaylse Trading Using An Rsi Divergence Cheatsheet

How Do You Make The Most Effective Anaylse Trading Using An Rsi Divergence Cheatsheet A RSI Divergence Cheat Sheet is used to detect possible buy and sell signals that are based on the divergence between the price and RSI indicator. These are the steps: Understanding RSI divergence: RSI divergence refers to the situation where an asset's price and its RSI indicator change in opposing directions. A bullish divergence is when the price makes lower lows, however, the RSI indicator is making higher lows. The phenomenon of bearish divergence may occur when the price has higher highs than the RSI while the RSI indicator has lower highs.

Use an RSI Divergence Cheat Sheet: There are a variety of cheat sheets that aid in identifying possible buy or sell signals from RSI divergence. A cheatsheet for bullish divergence could recommend buying when RSI indicators cross more than 30 and is making a higher low. Conversely, a bearish divergence sheet might recommend selling when the RSI indicators cross lower than 70 and is making an lower top.

Identify Potential Buy/Sell Signals. If you've got a cheatsheet, you are able to utilize it to determine buy/sell signals based upon RSI Divergence. For example, if you spot an indication of a bullish divergence on the chart, you could look into purchasing the asset. If, on the other hand, you spot an indicator of a bearish divergence you might think about selling the asset.

Make sure you confirm the signal. It is also possible to consider other indicators such as moving averages, or levels of support and resistance to confirm your signal.

Manage Risk: RSI divergence trading is similar to any other strategy to trade. It is possible to do this by placing stop-loss order to limit the possibility of losses, or by altering the size of your position based on the risk you are willing to take.

Analyzing divergence by using the RSI Divergence Cheat Sheet is the identification of potential buy or sell signals by looking at the divergence between the price and RSI indicator and then confirming it with other indicators of technical nature, or price action analysis. Before you use this strategy for trading live, it is important to know the risks involved and thoroughly test it with the historical data. View the top rated

trading platform for blog advice including 3commas tradingview bot, the best automated trading system, trading auto, best robot trading 2020, best exchange for crypto, forex scalping forum, best crypto exchange platform, cryptocurrency platforms, tradingview robot trading, crypto margin trading exchanges, and more.