What Exactly Is Automated Forex Trading, And What Strategies Or Tactics To Follow? Automated Forex Trading refers to the use of computer software or trading algorithm to execute trades in foreign exchange markets. The programs are created to follow specific trading rules and strategies, with the aim of maximizing profits while minimising losses.To implement effective strategies and techniques to automate Forex trading There are a few important things to take into consideration:

Automated trading software is readily available in the marketplace. It's crucial to choose an automated trading program that is safe and compatible with your trading objectives.

Develop a plan for trading: Before automating trading, it is essential to have a clear trading strategy. This includes identifying market conditions that you wish to trade, setting entries and expiration times as well as placing Stop loss orders.

Make sure you have a plan for managing risk A trading platform that is automated should include a system for minimising the risk of losing money. This means setting stop-loss limits and limit trades.

Before you use your strategy for live trading It is crucial to test your strategy on previous data. This will allow you to identify areas of weakness and make the needed adjustments.

Monitor your automated trading system. Automated trading may be time-saving, however it's vital to keep it in check regularly and make any necessary adjustments.

Stay current with market conditions: Automated Forex trading is an effective strategy. It's essential to stay current with the market's conditions to be able to modify your strategy to match.

Automated Forex trading is only possible using a trusted software The strategy to trade is clearly defined and risk management is efficient and there are regular adjustments and monitoring. Have a look at the recommended

click here on crypto trading backtesting for blog tips including interactive brokers cryptocurrency, penny stock trading forum, tastyworks crypto, robot trading software, crypto exchange arbitrage, crypto trading times, webull cryptocurrency, best coin trading platform, timothy sykes chat room, world top crypto exchanges, and more.

How Do Cryptocurrency Trading Bots Function In Automated Trading Software?

How Do Cryptocurrency Trading Bots Function In Automated Trading Software? A set of rules that are pre-defined is adhered to by the trading software that trades cryptocurrency, and the bot executes trades on behalf of the user. Here's how they work. Trading Strategy: The user decides on the strategy to use for trading. This covers entry and exit rules as well as the size of the position as well as risk management.

Integration: Through APIs, the trading bot is able to be integrated with cryptocurrency exchanges. This allows it to get real-time market information and to execute trades.

Algorithms: The bot employs algorithms to study market data and take decisions based on a trading strategy.

Execution. The robot executes trades based upon the rules in the trading strategy. It does not need manual intervention.

Monitoring: The bot constantly checks the market and adjusts the trading strategy if needed.

Cryptocurrency trading bots are useful in the execution of repetitive or complex trading strategies, decreasing the need for manual intervention and giving the user the ability to profit from trading opportunities all day long. Automated trading has the inherent dangers. There is the chance for software mistakes and security vulnerabilities. Additionally, there is the possibility of losing of control over the trading decision-making process. It is crucial to thoroughly evaluate and test any trading bot before using it for live trading. Read the most popular

good on trading platform cryptocurrency for more info including cryptocurrency stock exchange, best crypto investment platform, tws automated trading, arbitrage automated software, fibonacci cryptocurrency, top cryptocurrency trading platforms, trading shiba inu, binbot pro robot, automated technical analysis, rakuten trade forum, and more.

What Factors Can Trigger Rsi To Diverge?

What Factors Can Trigger Rsi To Diverge? Definition: RSI Divergence is a technical analysis tool that analyzes the direction in which an asset's price changes to the direction of its relative strength index (RSI). Types There are two types of RSI divergence, regular divergence and hidden divergence.

Regular Divergence is the situation where an asset's value makes lower or higher lows while its RSI is at an upper or lower high. It could also indicate a possible trend reversal. It is important to take into account other fundamental and technical factors.

Hidden Divergence: This happens when an asset's value has a lower or a higher low, while its RSI displays an upper or lower low. Although it's a less strong indicator than regular divergence it could still signal a possible trend reversal.

Take into account technical aspects

Trend lines and support/resistance levels

Volume levels

Moving averages

Other oscillators and technical indicators as well as other oscillators

Think about these basic aspects:

Releases of data on economic issues

Information specific to your company

Sentiment indicators for the market

Global developments and their effect on the market

It is essential to take into consideration technical as well as fundamental aspects prior to investing in RSI divergence signals.

Signal: Positive RSI divergence is an upbeat signal. Negative RSI divergence is an alarm for bears.

Trend Reversal : RSI divergence may indicate a trend reversal.

Confirmation - RSI divergence must always be considered an indicator of confirmation when it is combined with other analysis methods.

Timeframe: RSI divergence may be examined at different times to gain different insights.

Overbought/Oversold RSI Values above 70 indicate overly high conditions. Values lower than 30 indicate that the market is oversold.

Interpretation: To allow RSI to be correctly understood, it is necessary to consider other factors that are fundamental and technical. Check out the most popular

helpful hints about RSI divergence for blog tips including buy ripple on robinhood, regulated crypto exchanges, forex chat room, blockchain exchange fees, crypto simulator app, best platform to day trade crypto, fx crypto trading, best crypto investment platform, altsignals, automated day trading, and more.

How Do You Analyse The Results Of Backtesting To Determine The Profit And Risk Of The Trading Strategy?

How Do You Analyse The Results Of Backtesting To Determine The Profit And Risk Of The Trading Strategy? The analysis of backtesting results is essential in determining the profitability and risk of an investment strategy. To analyse backtesting results, you follow these steps in calculating the performance metrics. This is the initial step to analyze backtesting results. It involves the calculation of performance metrics like the total returns, average return and maximum drawdown. These metrics offer an insight into the profit margin as well as the risks associated with trading strategy.

Compare to benchmarks: Comparing performance metrics of the trading strategy with benchmarks like the S&P 500 or a market index can provide an idea of how the strategy has was able to perform in relation to the larger market.

Assess the risk management techniques: Examine the risk management strategies in your trading strategy. For instance, stop loss orders and the size of your position. To evaluate the effectiveness of these tools in reducing the risk,

Be aware of trends: Examine the strategy's performance over time in order to find patterns or trends regarding profitability and risk. This can help you determine areas that may require adjustment.

Take into consideration market conditions: Think about the market conditions during the backtesting period like volatility or liquidity. Then, evaluate how the strategy performed in various market conditions.

Backtest with different parameters: Test the strategy with various parameters, such as the criteria for entry and exit or risk management techniques to determine how the strategy performs under various conditions.

The strategy can be modified as needed: The backtesting analysis will determine if the strategy is suitable to your requirements.

Backtesting results require a detailed analysis of performance metrics, risk management strategies, market conditions, and any other elements which could impact the success or the risk associated with a particular trading strategy. By taking the time to thoroughly look over backtest results, traders will be able to identify areas to improve and adapt their strategy accordingly. Take a look at the best

backtesting trading strategies hints for site advice including top crypto trading apps, forex crypto, cryptocurrency exchange fees, trade ideas free chat room, expert advisor forex robot, pbx trading reddit, top cryptocurrency investment platforms, crypto exchange with most coins, tradestation automation, metatrader forum, and more.

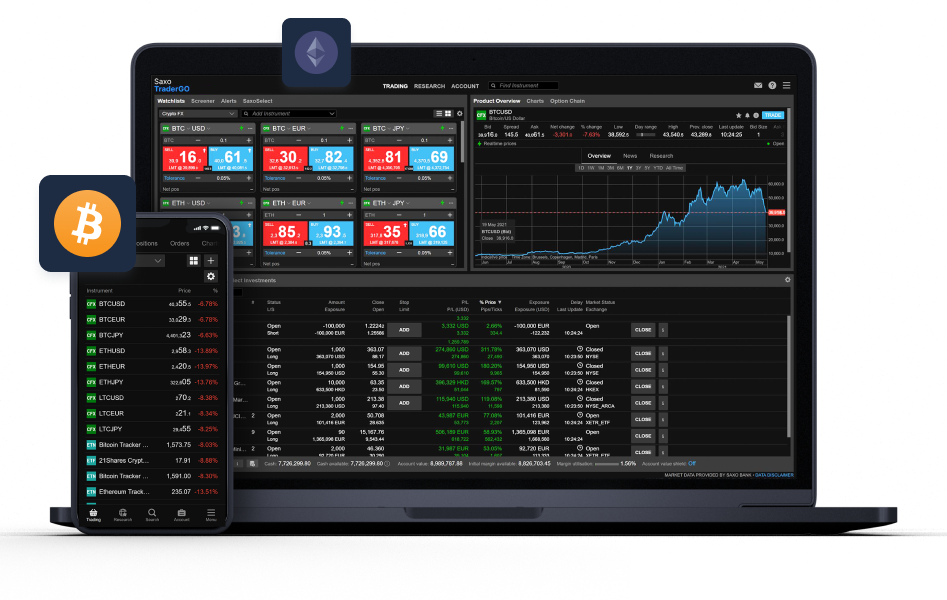

What Are The Distinctions Between Platforms For Trading In Cryptocurrency?

What Are The Distinctions Between Platforms For Trading In Cryptocurrency? There are many factors that distinguish online cryptocurrency trading platforms. Some platforms may provide more secure security measures like cold storage, two-factor authentication, while others might be less secure, which exposes them to hacking and theft.

User Interface: It's possible to have a variety of user interfaces available for cryptocurrency trading platforms. They can range from easy and intuitive to more complicated and challenging to navigate. Some platforms might offer more advanced tools and features, whereas others cater to beginners.

Trading Fees: A key difference between cryptocurrency trading platforms is the trading fees they charge. Although some platforms have higher charges for trading, others provide lower fees for trading in exchange for a narrower range of trading pairs and less advanced trading features.

Different platforms can support various cryptocurrencies that can affect the options available to traders. Certain platforms may have more trading pairs available, while other platforms may only support certain of the widely used cryptocurrency.

Regulation: Each platform could be subject to different levels of regulation or oversight. While some platforms may have more regulation, others operate with less oversight.

Customer Support The various cryptocurrency trading platforms can offer various levels and types of customer support. While some platforms provide live chat support or phone support 24/7, others offer only limited hours of support via email or phone.

In short there are many important differences between online trading platforms for crypto. These elements can have a significant influence on your trading experience as well as the risk. View the top rated

forex backtest software url for site examples including best crypto to day trade 2021, td ameritrade crypto trading, pro real time automated trading, binance trading platform, tradestation automated trading system, crypto trading no fees, ascendex crypto, bityard trading, beginner crypto trading, automated backtesting forex, and more.