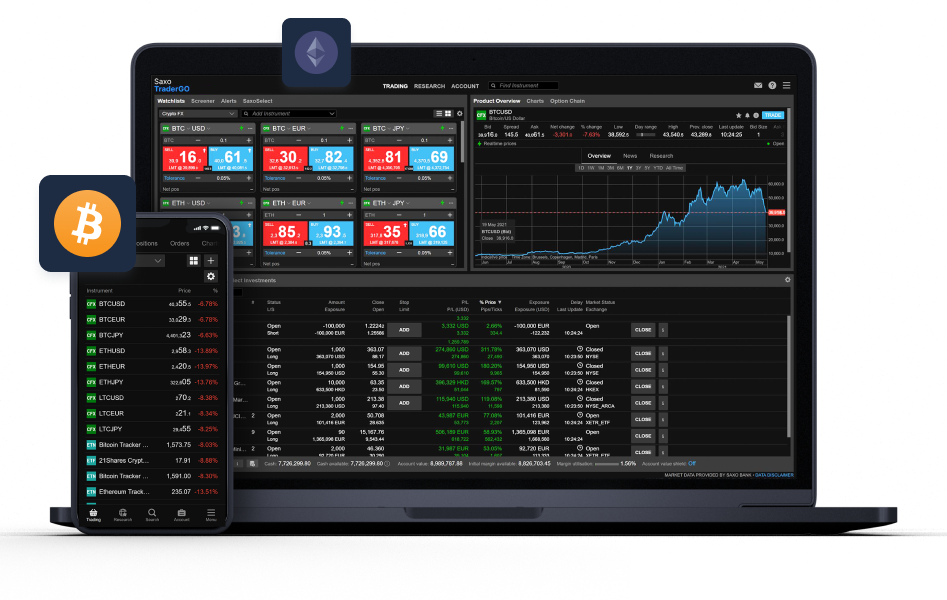

What Exactly Is Automated Crypto Trading And What Strategies And Tactics Can One Use? Automated crypto trading involves the application of computers and algorithms to execute trades on the market for cryptocurrency. These programs are created to adhere to specific rules of trading to maximize profits while minimizing losses.

You have many options for software that automates trading. It is important to select an appropriate software with experience and has the ability to be utilized with your trading needs.

Develop a trading strategy: It is essential to have a well-defined trading strategy prior to beginning automated trading. This includes determining the market conditions you wish to trade in as well as setting the entries and exits, as well as setting stop-loss order.

Be sure to implement a risk-management system A trading program that is successful will incorporate a risk mitigation system. This will help minimize the risk of losing funds. This might include setting stop loss orders as well as limiting the trade volume at any given time.

The strategy should be tested: Before applying your strategy live trading it, you need to check your previous data. This will help you find any flaws in your strategy, and then make adjustments.

Check your automated trading system. Automated trades can be time-saving, however it is essential to monitor it regularly to make sure that it's working correctly.

Keep up-to-date with market trends It's essential to stay on top of the market and adapt your strategies accordingly to make sure you succeed in the automated trading of cryptos.

Use a diversified portfolio to maximize your potential profits and spread risk: The cryptocurrency market can be volatile.

Automated crypto trading is a complex procedure that requires reliable software, a well-defined trading strategy, and efficient risk management. View the recommended

recommended site for forex backtesting for more advice including stocks automated trading system, crypto swap, copy trading forum, best auto trading robot, 3commas app, automated forex trading software for beginners, robinhood crypto states, ats automated trading system, auto hedging software, automated copy trading, and more.

How Do You Examine Forex Backtesting Software When Trading With Divergence?

How Do You Examine Forex Backtesting Software When Trading With Divergence? When looking at software for backtesting forex in order to trade with RSI Divergence, these factors should be considered. Quality of data: Check that the program has access to and can use historical data from the forex pairs trading.

Flexibility: Software must be flexible enough to allow customization and testing of various RSI diversification trading strategies.

Metrics: The software must provide a wide range of indicators to assess the effectiveness of RSI divergence trading strategies, including profit, risk/reward ratios drawdowns, and other pertinent measures.

Speed: Software must be efficient and quick so that it can be used for quick backtesting of multiple strategies.

User-Friendliness. Even for those who don't have a lot of technical analysis knowledge, the software must be simple to use.

Cost: Think about the price of the software and then determine if you can pay for it.

Support: Good customer support is required, which includes tutorials, as well as technical assistance.

Integration: The program must integrate with other trading tools like charting software, or trading platforms.

To ensure that the software is suitable for your requirements It is recommended to test it out first with the demo prior to purchasing an expensive subscription. See the most popular

RSI divergence examples for site recommendations including expert advisor programming for metatrader 5, cryptocurrency cfd, robot to trade forex, forex trading forum, phemex crypto exchange, swing trading forum, plus500 forum, fx crypto, best crypto exchanges reddit, stock market chat room, and more.

What Exactly Is A Cryptocurrency Trading Backtester And How Do You Integrate It Into Your Strategy?

What Exactly Is A Cryptocurrency Trading Backtester And How Do You Integrate It Into Your Strategy? A cryptocurrency trading tester allows the strategy and you to be compared against historical prices to see how they will perform in the near future. This is a great instrument to test the effectiveness of a trading system , without placing any money at risk.

Choose a backtesting platform: There are many platforms for testing strategies to trade with crypto including TradingView, Backtest Rookies, and TradingSim. You can pick the one that best suits your needs and your budget.

Determine your strategy for trading. Before you are able to back-test it, you must establish the rules you'll use for entering and exiting trades. These could include indicators that are technical such as Bollinger Bands, moving averages, or RSI. It may also include other criteria , such as trading quantity or news events.

Create the backtest: Once your trading strategy has been established, you can create the backtest for the chosen platform. This typically involves selecting the currency pair you wish to trade as well as setting the time frame for testing, and any other parameters that are specific to your particular strategy.

When you have completed the backtest, you've set up the backtest, it is possible to test it to determine how your trading strategy would have performed over time. The backtester produces reports of the results of your trade, which include the win/loss, profit, loss and other metrics.

Review the results If you are able to look over the backtest results it is possible to modify your plan to increase its effectiveness.

Test the strategy forward. After you've made any changes, you can forward-test it using a demo account. Or with some actual money. This will let you test the effectiveness of the strategy under trading conditions that are real-time.

Incorporating an automated backtester for trading crypto to your trading strategy, you will get valuable insight into how your strategy would have been performing in the past and then apply this knowledge to enhance your trading strategy moving forward. Follow the top rated

clicking here on forex backtesting software free for more advice including webull cryptocurrency, best crypto buying apps, etrade crypto trading, fully automated futures trading, mt5 automated trading robot, gemini trading app, best day trading forums, tradestation automated trading strategies, nest trader automation, stock traders community, and more.

What Is Crypto-Backtesting ? Rsi Divergence And Stop Loss Calculators?

What Is Crypto-Backtesting ? Rsi Divergence And Stop Loss Calculators? Backtesting cryptocurrency using RSI diversgence, stoploss, and the position sizing tool is an effective way to test a trading strategy that uses the Relative Strength Index. (RSI) Position sizing, position sizing, and stoploss tools. RSI divergence is defined as a method of technical analysis in which the price action of an investment is assessed against the RSI indicator. It's useful in identifying potential trend reversals. It is used to limit potential losses if the market moves against an investment. The calculation of position size is a method to determine the appropriate amount of capital required to invest in a trade. It's based on the level of risk-taking capacity of the trader as well as the account balance.

These steps can be used to test strategies for trading using RSI stop loss divergence and position sizing.

Determine the strategy for trading. By using RSI Divergence Stop Loss, Stop Loss and a calculator for sizing positions, determine the rules and guidelines to enter or exit trades.

Collect historical information: Get historical price data on the cryptocurrency you wish to trade. These data are available from many sources such as the data providers or cryptocurrency exchanges.

Backtest the strategy. Use R to backtest trading strategies using historical data. Backtesting algorithms could comprise the RSI indicator, stop-loss calculator, and the calculation of sizing for positions.

Analyze and analyze the results. Use the backtesting results as a basis to evaluate the effectiveness of your trading strategy. Adjust the strategy as necessary to improve its performance.

There are many well-known R software packages to backtest trading strategies, including quantstrat, TTR, and Blotter. These packages offer many functions and tools to backtest trading strategies with various technical indicators as well as strategies for managing risk.

An effective way to test and develop a trading system for cryptocurrencies is to utilize RSI divergence (stop loss), and the size of your position. It's important that you examine your strategy with historical data, and be sure to review and alter the strategy in response to market changes. View the recommended

check this out on backtesting strategies for more recommendations including robinhood instant deposit crypto, bybit exchange, crypto staking etoro, best crypto exchange for beginners, best crypto to trade today, crypto arbitrage app, forex day trading forum, cryptohopper forum, fully automated forex trading software, wunderbit strategy, and more.

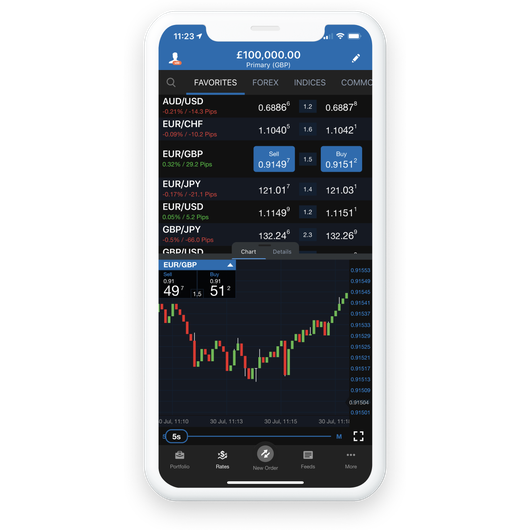

What Are The Main Distinctions Between The Cryptocurrency Trading Websites?

What Are The Main Distinctions Between The Cryptocurrency Trading Websites? There are many factors that are different between cryptocurrency trading platforms. Some platforms might have stronger security measures such two-factor authentication or cold deposit of funds. Other platforms may have less secure security, which can make their platforms more vulnerable and more vulnerable to theft.

User Interface: There are many choices for the user interface on a cryptocurrency trading platform. It can be simple and easy to complicated and difficult to navigate. Certain platforms offer more advanced tools for trading or features while others might be more suitable for beginners.

Trading Fees. Another important distinction between cryptocurrency trading platform. While some platforms charge higher fees for trading, other platforms charge lower fees in return for a limited trading range or more advanced trading capabilities.

Supported cryptocurrency: Different platforms may support various cryptocurrencies. This may influence the options for trading that are available to users. Certain platforms can support more trading pairs than others, while some only support the use of a few popular currencies.

Regulation: There are various levels of regulation and oversight that may differ among cryptocurrency trading platforms. While certain platforms are more tightly controlled than others, other platforms have no oversight.

Customer Service: There are numerous aspects that affect the quality and quality of customer support offered by cryptocurrency trading platforms. Some platforms may offer 24/7 support for customers via live chat or telephone, while others may only provide email support or restricted hours of operation.

In the end, there are many key differences between online crypto trading platforms. These factors are important to think about when selecting a trading platform. They can affect the trading experience, as well as the risk level. View the most popular

watch this video about automated crypto trading for more info including macd bot crypto, interactive broker review reddit, automated stock trading algorithms, robo trader software, robotic trading, poloniex crypto exchange, binary auto trading robot, top exchanges crypto, tradesanta, arbitrage coin, and more.