What Are The Strategies For Backtesting For Trading Crypto? Backtesting trading strategies in crypto trading involves simulating the application of a trading strategy by using historical data to evaluate its potential profitability. Here are some steps to follow for back-testing a strategies for trading in crypto: Historical data: You will have to collect historical data sets that include volumes, prices, and other market data that is relevant to the situation.

Trading Strategy: Define the trading strategies that are being test.

Simulation: Simulate the trading strategy with software that utilizes historical data. This lets you see how your strategy would have performed in the past.

Metrics: Evaluate the performance of the strategy with metrics such as profitability, Sharpe ratio, drawdown, and any other measures that are relevant.

Optimization Change the parameters of your strategy, and then run the simulation once more to optimize the strategy's performance.

Validation: Test the effectiveness of your strategy by using data that is out-of-sample in order to test the strategy's reliability.

It is important that you be aware that past performance isn't an indication of future outcomes. The results of backtesting should not be relied on to guarantee future profits. Also, live trading requires that you consider market volatility, transaction fees and other issues in the real world. Read the top rated

forex trading recommendations for more examples including fx algorithmic trading strategies, tradingview automated trading binance, sell crypto robinhood, crypto binance trading telegram, automated trading apps, etoro crypto, cryptocurrency simulator, trality bot crypto, automated crypto trading, auto trade td ameritrade, and more.

Which Forex Backtesting Software Do You Own And How Do You Best Use It?

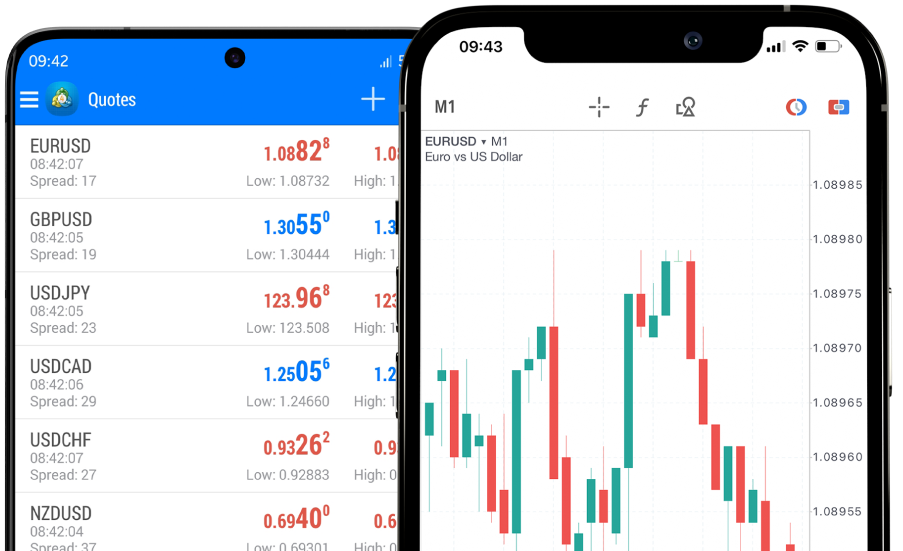

Which Forex Backtesting Software Do You Own And How Do You Best Use It? There are numerous forex backtesting options, each with their specific capabilities. MetaTrader 4/5: MetaTrader 5 is a widely used forex trading platform. This platform includes a strategy tester, which lets you test your trading strategies back. It allows traders to try out strategies using data from the past as well as optimize settings and examine the results.

TradingView is a website-based platform to analyze and chart. It also supports backtesting. It lets traders experiment with and develop strategies using their Pine Script programming language.

Forex Tester: This is a separate software designed for backtesting forex trading strategies. This program includes a range of tests and analysis instruments. It also allows you to simulate different market conditions , so you can test multiple strategies simultaneously.

QuantConnect The cloud-based platform lets traders back-test strategies for trading forex using a variety programming languages such as C#, Python, F#.

These steps are essential to use Forex backtesting software to its fullest.

Determine your strategy for trading. Before you begin backtesting, it is important to establish the rules and criteria you'll use to trade in and out. This may include indicators for technical analysis or chart patterns.

Create the backtest Once you have defined your strategy, you can configure the backtest using the software you choose. It usually involves selecting the currency pair you want and setting the timeframe and any other parameters specific for your plan.

Run the backtest. After the backtest has been set up, you can use it to check how your strategy performed over the years. Backtesting software produces an report that contains the results of every trade.

Examine your results: After conducting the test, you are able to review the results to see how your strategy performed. If you are able to look over the backtest results it is possible to adjust the strategy to improve its performance.

Test the strategy by forward-testing it If you make any needed adjustments, you can forward-test the strategy using an account that is demo or a small amount of real money in order to determine how it performs under real-time trading conditions.

Forex backtesting software lets you gain invaluable insight into the effectiveness of your strategy in the past. The information gained can be utilized to enhance your trading strategies going forward. Have a look at the best

position sizing calculator for website recommendations including metatrader 5 cryptocurrency, automated stock trading robot, mt4 crypto brokers, robo trading forex, trading crypto on webull, top crypto platforms, interactive brokers auto trading, crypto futures, ats automated trading system, currency trading forum, and more.

What Exactly Is An Automated Trade Bot? What Are The Software Platforms?

What Exactly Is An Automated Trade Bot? What Are The Software Platforms? An automated trading robot is a computer program that performs trades on behalf of a trader using pre-set rules. These bots analyze market data like price charts and technical indicators and execute trades based upon the strategies and rules established by the trader. C++ and Java are the most popular programming languages used by automated trade bots. The preferences of the trader will decide the platform or software that is used and how compatible it is with the trading platform.

Here are some examples of platforms and software which can be used to build automated trading bots.

MetaTrader: This popular trading platform allows traders to design and execute automated trading robots using the MQL programming languages.

TradingView: This software lets traders to develop and test trading strategies using their Pine Script programming language.

Cryptohopper This platform was specifically designed to automate the trading of cryptocurrency. It lets traders develop their bots using the aid of a visual editor and then back-test their strategies using historical data.

Zenbot: Zenbot can be customized on any platform including Windows, macOS or Linux.

Python-based libraries There are a variety of Python-based libraries such as PyAlgoTrade or Backtrader which allow traders to develop and implement automated trading bots with the Python programming language.

The particular software and platform chosen will depend on the preference of the trader and the compatibility with the trading and exchange platform. View the top

going here about rsi divergence cheat sheet for blog examples including nse robot trading, hitbtc fees, torque trading reddit, robot to trade forex, social trading crypto, arbitrage trading platform, binance trading fees, best option trading chat rooms, tim sykes challenge chat room, robinhood crypto restricted, and more.

What Is Crypto Backtesting?

What Is Crypto Backtesting? Backtesting cryptocurrency using RSI diversgence, stoploss and position sizing tool is a method to evaluate the effectiveness of a trading strategy that utilizes the Relative Strength Index. (RSI), position sizing and stoploss tools. RSI divergence is a scientific analysis method that compares the price movement of an asset with its RSI indicator. It is used to identify possible trends that could reverse and can be a valuable tool when developing an investment strategy.A Stop loss is an agreement with a broker that allows them to sell an asset when it is at the price of a specific amount. It assists in limiting the risk of loss should the market shift against a position. The calculator for sizing positions determines the amount of capital that a trader should take on according to their risk tolerance and the current balance of their account.

To backtest a trading strategy using RSI divergence or stop loss position sizing calculator to backtest your strategy, follow these steps:

Set out your trading strategy. These rules will allow you to open and close trades based on RSI, stop loss, and position sizing.

Gather historical prices It is a method to gather historical price information regarding the cryptocurrency you're interested in trading. These data may come from different sources such as data providers and cryptocurrency exchanges.

Backtest the strategy: You can use R to test your trading strategy using historical data. Backtesting algorithms could comprise the RSI indicator as well as the stop-loss calculator and the calculation of sizing for positions.

Examine your results: Review the backtesting results to determine the potential risk or profit of the trading strategy. The strategy can be adjusted if needed to improve its efficiency.

The most popular R programs for backtesting trading strategy are quantstrat and blotter. These packages provide a range of tools and functions for testing trading strategies by backtesting them using various technical indicators and strategies for managing risk.

The RSI divergence, stop-loss, and position sizing calculator are all effective ways to design and test a cryptocurrency trading strategy. It is essential to test your strategy using previous data and ensure that you monitor and adjust the strategy when market conditions change. Follow the top

blog.cleo.finance/trade-rsi-divergence-automatically crypto site for site recommendations including automated trading companies, automated trading system, best app to buy crypto, cfd automated trading, best trading apps for crypto, phemex crypto exchange, commodity auto trading software, bitstamp automated trading, binance auto bot, top crypto exchanges 2020, and more.

What Are The Main Differences Between Online Platforms For Trading In Cryptocurrency?

What Are The Main Differences Between Online Platforms For Trading In Cryptocurrency? There are many important differences between online crypto trading platforms. Some platforms may offer more secure security features like cold storage, two-factor authentication. However, other platforms might have less secure security, which makes them more vulnerable to theft and hacking.

User Interface: The interface for platforms for trading in cryptocurrency may be simple and easy to more complicated and difficult to navigate. Certain platforms might offer more advanced trading tools and features, while others may be geared more toward beginners.

Trading Fees. There is another difference between cryptocurrency trading platforms. Certain platforms charge higher fees to trades, while other platforms may offer lower fees for exchange of a smaller trading pair, or have more sophisticated trading features.

Supported cryptocurrency: Different platforms may support various cryptocurrencies. This can influence the options for trading that are offered to customers. Although some platforms provide greater trading options than other, others might only be able to accept the most well-known cryptocurrencies.

Regulation The different cryptocurrency trading platforms have different levels of regulation. While certain platforms are more tightly controlled than others, others operate without much oversight.

Customer support: It's possible for various platforms to offer different levels of customer support. Some platforms provide 24/7 customer support via phone, chat, or via live chat. Other platforms may limit customers to email support, or not provide it at all.

There are many important differences between cryptocurrency trading platforms. These include security, user interfaces as well as trading fees and other supported cryptocurrency. These elements can have a significant influence on your trading experience and risk. Have a look at the top rated

automated trading bot examples for site recommendations including stock trading chat rooms, most trustworthy crypto exchange, bot trading for binance, nasdaq automated trading system, auto pilot trader, sierra chart automated trading, best cryptocurrency to trade daily, crypto ai trading, automated forex tools, zulutrade forum, and more.